SEVEN KEY SIGNALS TO MONITOR FOR VENEZUELAN TRADE FLOWS

The US intervention in Venezuela raises uncertainty for business and trade – some of the key trends to look out for

The US intervention in Venezuela raises uncertainty for business and trade – some of the key trends to look out for

Credit: David Paterson via Pixabay

“Information is valuable, but information overload is a nightmare.”

Here are seven key signals to monitor for positive changes in Venezuelan trade flows:

1. Political Rhetoric - In spite of President Trump’s assertion that USA will “run” Venezuela, the interim president, Delcy Rodriguez, is not necessarily pro-US, but has called for a “balanced” relationship with USA while still insisting on return of Maduro. So far there is no “opposition revival” or “military coup”. The change in tone will need to be monitored & analysed.

2. Corporate Moves - So far, the US Oil companies, who will be central to any US influence, have kept quiet as they know that the situation is still fluid and it is unlikely that they will be “welcomed” into Venezuela by the masses or the government. Chevron continues to operate there but its own position is more precarious now. Any positive move by US Oil companies – statements or actions – will go a long way in reviving trade.

3. Sanctions relief or policy changes - Any easing of US or international sanctions, new trade agreements, or changes in diplomatic relations would be a leading indicator of potential trade expansion. This is something that US can do, once they have to confidence in the transactional system in Venezuela.

4. Private sector investment and joint ventures – An easing of sanctions will most likely lead to new foreign direct investment, international partnerships, or rehabilitation of industrial facilities would signal confidence in Venezuela's trade prospects and operational environment.

Rystad Energy believes that around $53 billion of oil and gas upstream and infrastructure investment is needed over the next 15 years just to keep Venezuela’s crude oil production flat at 1.1 million bpd. Moreover, they estimate that only 300,000 bpd of additional supply can be restored within the next 2-3 years with limited incremental spending. Going beyond 1.4 million bpd level is possible but would require a stable investment of $8-9 billion per year from 2026 to 2040, on top of ‘hold-flat’ capital requirements. Venezuelan crude oil production could then recover to 2 million bpd by 2032 and to 3 million bpd by 2040. The total oil and gas capex required over the 2026-2040 period to reach that target is estimated at $183 billion.

5. Foreign exchange reserves and currency stability – If the US or any of its allies/proxies decide to prop up the central bank reserves (President Trump has done it in Argentina) and a more stable Bolívar exchange rate prevails, that would suggest better trade performance and increased hard currency inflows from exports.

6. Non-oil export diversification - Growth in traditionally strong sectors like aluminium, gold, agricultural products, or petrochemicals would indicate economic diversification and reduced dependence on crude oil alone. Interestingly, the major consumers of these commodities sit in Asia, including India and China. This will create complicated geopolitical scenarios.

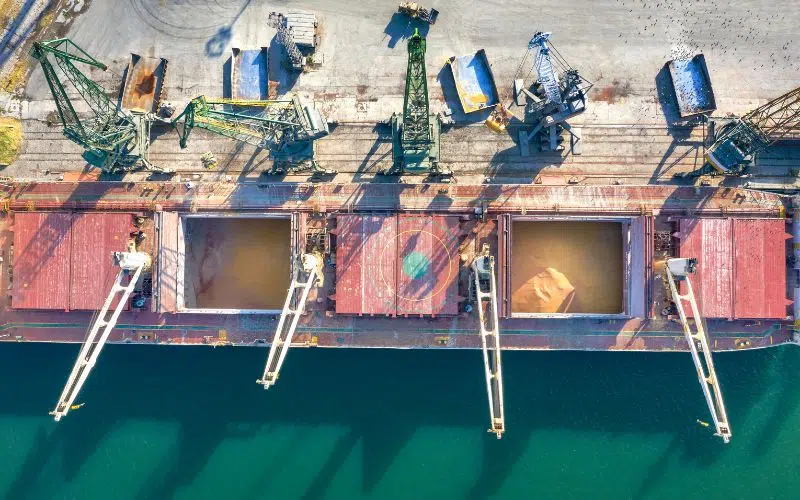

7. Port activity and shipping data – Finally, there is no hiding for the trade anymore. With greater use of technology, there is greater visibility of the loadings ex Venezuela. Signs of increased cargo volumes at major Venezuelan ports like Puerto Cabello and La Guaira, along with more vessel arrivals and shorter turnaround times, would signal improving trade infrastructure and commercial activity.

As I said, there is going to be a lot of noise out there but if you monitor the headlines that impact your bottom lines, the opportunities can be capitalised upon.

Punit Oza