NONE

none

none

none

none

Việc kết thúc miễn trừ cũng đã dẫn đến mức tăng 82% trong việc thu giữ hàng hóa giá rẻ được coi là không an toàn hoặc không tuân thủ, theo Cơ quan Hải quan và Bảo vệ Biên giới.

The exemption's end has also led to an 82% jump in seizures of low-cost goods considered unsafe or noncompliant, per Customs and Border Protection.

Sự can thiệp của Mỹ vào Venezuela tạo ra sự không chắc chắn cho kinh doanh và thương mại – một số xu hướng chính cần chú ý đến

The US intervention in Venezuela raises uncertainty for business and trade – some of the key trends to look out for

Many of you have used a consol box.. Here we look at what it is, how it works and the pros and cons of using a consol box..

Nhiều người trong số các bạn đã sử dụng hộp điều khiển.. Ở đây chúng ta sẽ xem xét nó là gì, cách nó hoạt động và những ưu nhược điểm của việc sử dụng một hộp điều khiển..

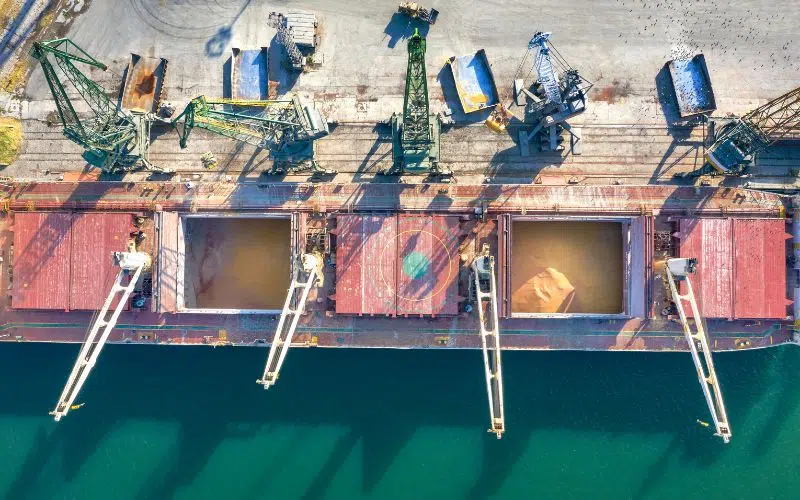

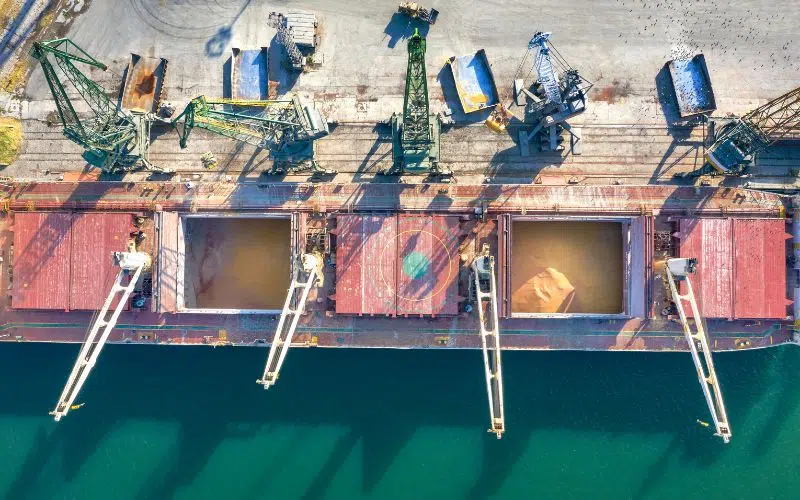

The legislation regarding the safe carriage of solid bulk cargo, the IMSBC Code or the International Maritime Solid Bulk Cargoes Code, became mandatory on

Luật liên quan đến vận chuyển an toàn hàng hóa rời dạng rắn, Bộ luật IMSBC hay Bộ luật Quốc tế về Hàng hóa Rời Dạng Rắn, đã trở thành bắt buộc vào

HD Korea Shipbuilding & Offshore Engineering is acquiring Doosan Vina’s yard specialising in fabrication.

Wallenius Wilhelmsen đã được trao Huy chương Vàng từ EcoVadis, một công ty đánh giá ESG, trong năm thứ hai liên tiếp.

The e-CO was first introduced in Vietnam in 2018. Specifically, the e-CO system has been deployed on the platform of the Customs Department under the Ministry of Finance. This represents a significant step in promoting the use of digital technology and reducing paper-based procedures in the process of verifying the origin of goods.

Ban hành kèm Thông tư số 38/2015/TT-BTC ngày 25/3/2015 của Bộ Tài chính PHỤ LỤC II CHỈ TIÊU THÔNG TIN LIÊN QUAN ĐẾN THỦ TỤC HẢI QUAN ĐIỆN TỬ ĐỐI VỚI HÀNG HÓA XUẤT KHẨU, NHẬP KHẨU

PHỤ LỤC I (Ban hành kèm Thông tư số 39/2018/TT-BTC ngày 20/4/2018 của Bộ trưởng Bộ Tài chính) Thay thế Phụ lục II Thông tư số 38/2015/TT-BTC như sau: Phụ lục II CHỈ TIÊU THÔNG TIN LIÊN QUAN ĐẾN THỦ TỤC HẢI QUAN ĐIỆN TỬ VÀ CHẾ ĐỘ QUẢN LÝ ĐỐI VỚI HÀNG HÓA XUẤT KHẨU, NHẬP KHẨU (Ban hành kèm Thông tư số 38/2015/TT-BTC ngày 25/3/2015 của Bộ trưởng Bộ Tài chính)